We’ve all heard the statistic: 80% of new product launches fail.

Why such high levels of failure from companies that clearly know what they are doing? They have processes in place, have stacks of consumer insight, and strong innovation functions within their businesses. They will have modelled it, sold it in, supported it, and yet…

What’s Missing? Real-Life Simulations

Let’s go back to the idea that companies have strong innovation and product development processes. They look for the consumer insights and challenges that need to be met, think about how their brand can meet them, design what the product will look like, show consumers a visual of it, customers say they like it—great!

Now imagine that singular product—representing a lot of time and investment—is set on the shelf, next to 20 other products in its immediate competitive context, on a fixture of 80 choices, in an aisle with 300 choices. Suddenly the reality of what it takes to ‘cut through’ or whether or not it is a genuinely new and different proposition becomes crystal clear.

It’s all very well asking consumers if they like an idea, if it’s appealing, if they think they would buy it. This is the classic System 2 style testing that is still used for innovation. Where other areas of consumer insight now understand the more instinctive, intuitive, System 1 brain, we still place consumers in a rational state of mind to ask them (almost plead with them) if they like our new ideas.

Testing innovation and new product launches in-store, with real shoppers, is the only true way to gauge if it stands a chance. Will they notice it? Will it engage them? Can it disrupt existing, often entrenched, habitual shopping behaviors? Are we trading people through our own portfolio? Are we stealing share from our competitors? What is the role of this innovation in the category as a whole?

New products need to understand themselves in the context of their competitors, fixture and category. Teams need to establish how shoppers will truly act in the moment, rather than relying on purchase intent – which is fundamentally a response of ‘good will’ on the part of the consumer. Will they part with their money in-store? That’s what we need to know.

But Testing In-Store Is Expensive And Time Consuming

Yes. It’s not feasible, for many reasons: financial, logistical, time constraints, etc. You might not even have a product to test if you’re still at the mock-up or prototype stage. Maybe you haven’t finalized the recipe, flavor, or format yet. More often than not, it’s just not a practical way to conduct research.

So What Now?

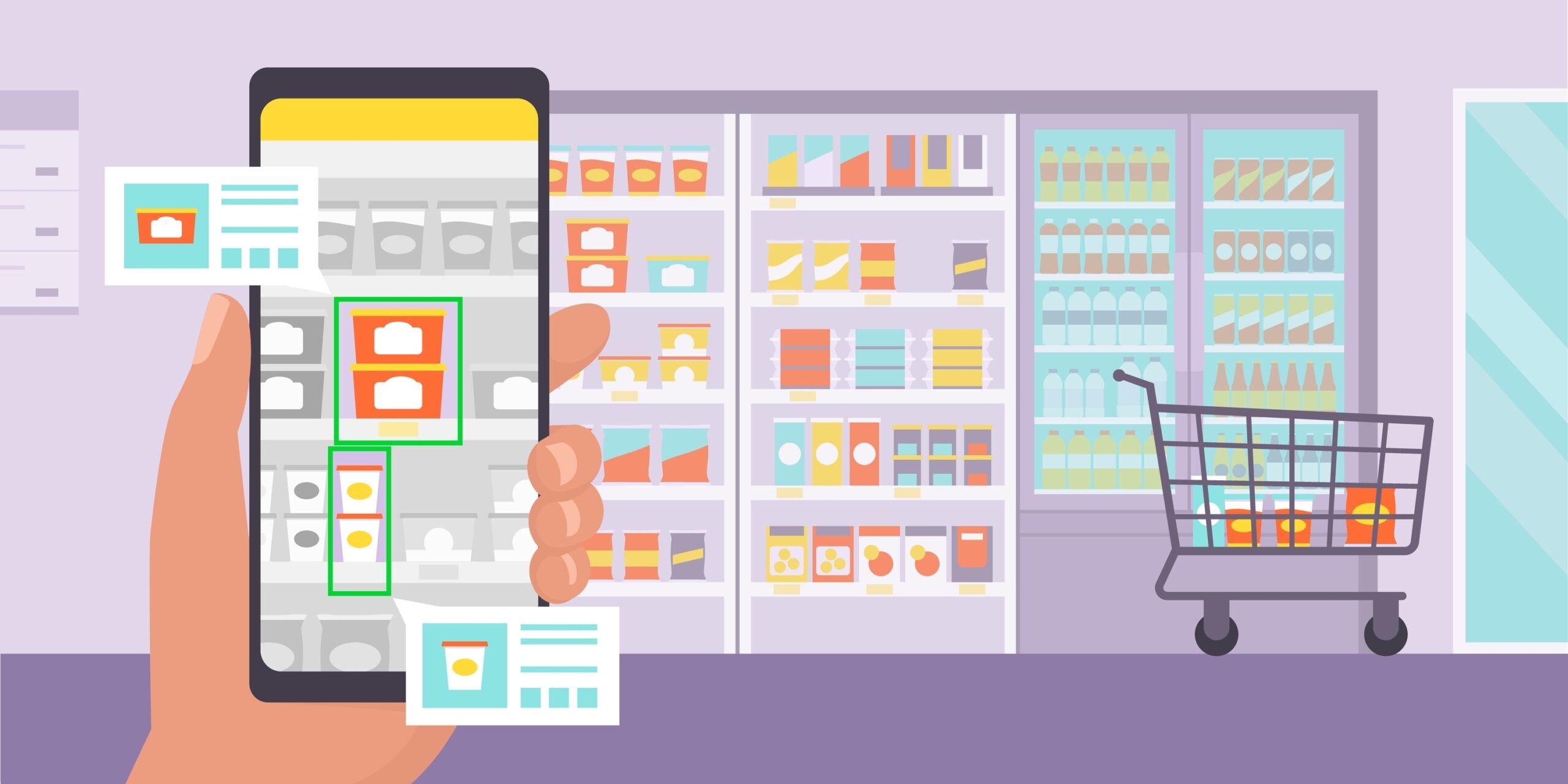

This: A virtual store with your specific shopper mission and category, and a fully-shopable 3D fixture of virtual product simulations. You can get everything as close to what you think will be executed in real-life as possible, with a store that reflects the environment consumers recognize and a full fixture they can interact with.

The insight opportunities are rich, and granular. How do they shop the fixture? What impact does the new product have, if any, on the shopper mission? Do they pick it up? Do they buy it? Where does that steal come from? Virtual gives you the meaningful research ‘sales data’ to understand how well any new product will perform in fixture.

Not only that, but it encourages better communication and collaboration with store-facing teams, by allowing them to view images and videos of your concept in their store, and understand the data behind the decisions.

De-risk the product launch process, feel certain about what the innovation will look like in context, engage retail partners with how your brand and products are delivering to the category vision–3D virtual store testing can do just that.

–Susy Weitz, European Insights Lead, InContextSusy is an insight, brand and creative strategy specialist with over 18 years experience in helping brands develop new ranges, manage their portfolio and category more effectively.

–Susy Weitz, European Insights Lead, InContextSusy is an insight, brand and creative strategy specialist with over 18 years experience in helping brands develop new ranges, manage their portfolio and category more effectively.