The retail industry went through a big period of change in the months following the global pandemic. We saw a huge shift in shopper behavior as consumers were staying at home. Retail e-commerce sales grew 32.4% year-over-year in 2020, and in 2021, grew another 16%. Shoppers became more frugal. Frozen foods made a comeback. The perimeter took a hit.

These shifts made a big impact on how stores operated, and how they continue to keep up with today’s ever-evolving shopper habits. As more people head back into the physical store, what changes do brands and retailers need to make in order to attract and maintain loyal customers? How does online shopping need to transform to meet shopper needs? Do in-store messaging and merchandising strategies need to be updated? In what ways will COVID-19 continue to affect the retail and consumer goods ecosystem? Below, we explore a few of the biggest shopper behavior trends to pay attention to, and how to meet shoppers’ needs through innovative solutions.

1. Continued Influence of the Global Pandemic

There’s no question that COVID-19 is still a major contributor to current shopping behavior. Physical store shopping has rebounded somewhat since the early days of the pandemic, but the way people shop in stores has changed. They require more space, they don’t want to stay as long, and they want flexibility. BOPIS, buying online and curbside pickup, grew nearly 23% in the second half of 2022, and that number is only predicted to increase as supply chain hiccups affect shipping times. Overall, consumer purchase behavior is based on their unique circumstances, and retailers and brands need to deliver.

What about e-commerce? Will COVID-19 abate to a point where shoppers are fully comfortable shopping in stores, and does that slow the growth of online shopping? Or will it continue to grow quickly as better and better online shopping experiences become available? Consumer trends are pointing toward the latter, as US e-commerce sales are set to exceed $1 trillion in 2022. Even as the pandemic hopefully begins transitioning to endemic, the way people shop will most likely not go back to the way things were, which means we’ll see more brands adopting an omnichannel approach to retail strategies. The good news is the new era of shopping is positioned to be even better.

2. Increased Branded Mobile App Usage

Many retailers have switched (or are considering switching) to their own online ordering, pick-up and delivery services. This enables their customer experiences to be branded, and will possibly cause a shift away from apps that service many retailers toward ones that offer a better experience with a few brands.

Many retailers were just getting started in these areas at the beginning of 2021, and used partners like Shipt and Instacart to execute the ordering, picking, and fulfillment of their online orders. Now, some retailers have taken all or some of that process in-house to achieve a better branded experience that customers will seek out. Kroger, for example, announced its partnership with grocery technology company Ocado Group to create new automated warehouses on the East and West Coasts, rather than rely on third-party services.

In-store apps have only improved in recent years, allowing shoppers to automatically apply discounts at checkout, find products, and pay all within the same platform. Remember QR codes? You probably do, as they’ve enjoyed an epic comeback when it comes to contactless, well, everything. From menus to payments to item returns, QR codes have made a huge impact on how seamlessly we use our mobile devices for commerce.

3. The Rise of Social Commerce

One of the fastest growing consumer trends right now is social commerce. According to the latest report from Accenture, the global social commerce industry is set to grow from $492 billion in 2021 to $1.2 trillion by 2025, three times the rate of traditional e-commerce. But what is it? Simply put, social commerce is the intersection of e-commerce and social media. Brands can harness social platforms, like Instagram, TikTok, Facebook, and more, to create a seamless path to purchase.

Social commerce is not only a direct sales tool. It is also how many brands can advertise, engage, and drive awareness outside of the physical store and traditional advertising methods. For example, Albertsons recently partnered with Pinterest to allow recipe seekers to add ingredients from recipes they find on Pinterest straight into their Alberton’s online shopping cart. In 2021, H-E-B began livestreaming shoppable cooking classes through Facebook. Globally, fresh foods and snack items are projected to make up 13% of social commerce purchases by 2025, per Accenture. Although much of that will be exclusive to China, brands and retailers in the U.S. should be ready to embrace and make the most of social commerce in the future.

4. Demand for Better Online Shopping Experiences

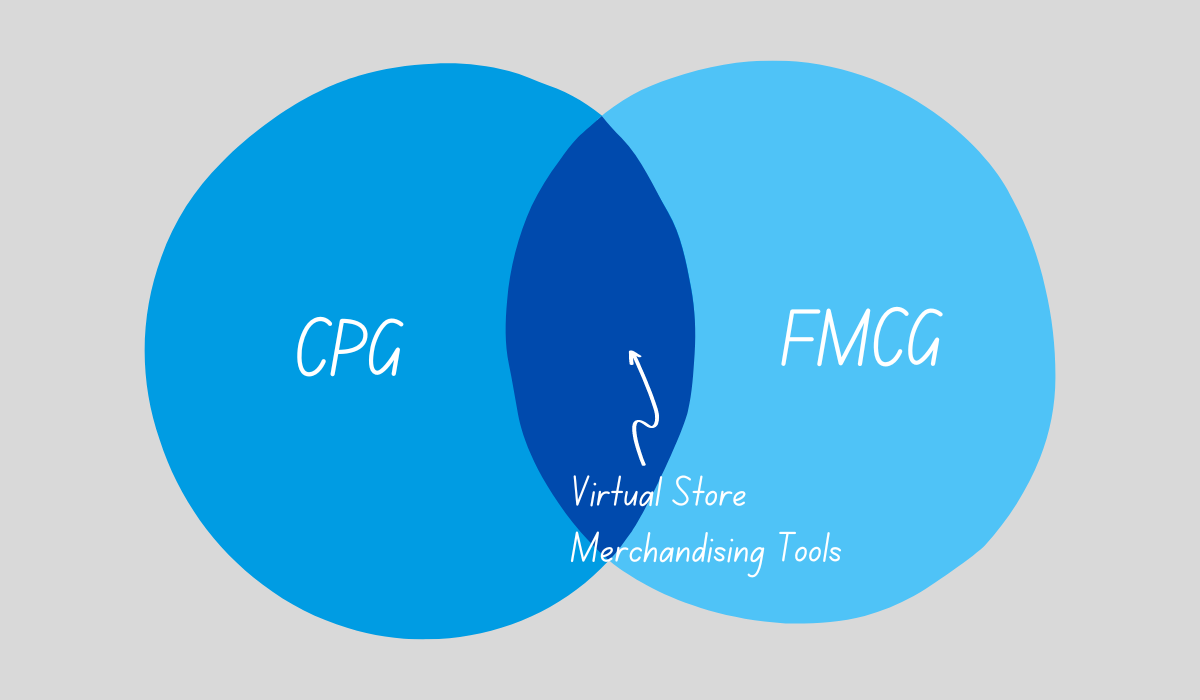

Simply put, the expectations about shopping online are evolving. Now that consumers are online-savvy, they want better, more seamless ways to shop, and more dynamic, engaging experiences. What might that look like? CPGs are looking to update their strategies to create more branded, direct-to-consumer experiences that compete with retailers. This, in turn, will drive retailers to require better e-commerce experiences that fit with their brands to continue attracting shoppers to buy from them.

Virtual commerce, or V-comm, is one way both retailers and brands are responding to this change in shopper behavior. By now you’ve most likely heard about the “metaverse”, which can be broadly defined as a term used to describe interacting through the use of online digital technology. Whether it’s social or economical, we can do things within the metaverse that we may not be able to do in the physical world. It encompasses virtual and augmented reality, but can also be experienced on a PC or through mobile devices.

Going forward, brands and retailers will begin to understand their place in the metaverse. What will that look like? Already you can find items you like in a store, add them to your digital shopping carts, then go home and view them in your space via augmented reality. The next step will be entering a 3D store from your computer or phone, allowing for organic discovery that closely resembles browsing a physical store. The physical limitations are removed, meaning brands can create unlimited experiences for any occasion or need—holidays, events, seasons can all be recreated online for shoppers to find everything they need in one space.

From a brand and retailer perspective, a VR style of interface allows shoppers to experience digital twins of a retailers’ current stores, deriving shopper insights about the experience that would apply just as well to the brick and mortar stores. Alternatively, if the online experiences in VR are unique, they can lend insights into how shoppers would most prefer to learn about a new product and purchase goods for each category.

The bottom line? CPGs should be looking to own their online experiences for their end customers, while simultaneously understanding how to partner with their current retailers in a unique online experience to provide as broad of an online presence for their products as they possibly can.

Technology will Drive 2022 Shopper Behavior Trends

We do not yet know how consumer behavior will evolve or exactly what the coming year will bring. But what we can count on is that technology is paving the way for ever more flexible, seamless, and engaging shopper experiences than ever before. If you are interested in using virtual technology for shopper research, reach out to InContext Solutions.